The deadline for submitting your Self-Assessment online, and paying any tax you owe, is midnight on the 31st January. If you prefer to submit a paper based return, the submission deadline is 31st October.

But what happens if you are late in submitting your tax return?

Unfortunately you’ll face an automatic fine from HMRC for missing the deadline. The more the delay before taking action, the larger the fine.

What are the fines for late Self-Assessment submission?

If you miss the deadline for filing, you will be hit by an automatic £100 fine from HMRC. Extra charges are added the longer you leave it.

Failure to submit within three months of the deadline (by the end of April), incurs an additional £10 a day fine for the next 90 days. This means the penalty will increase by £900 – bringing the total penalty to £1,000.

If you still haven’t filed after six months or even 12 months, you will face further penalties based on the amount of tax that you owe. Interest is also charged on top of the unpaid tax.

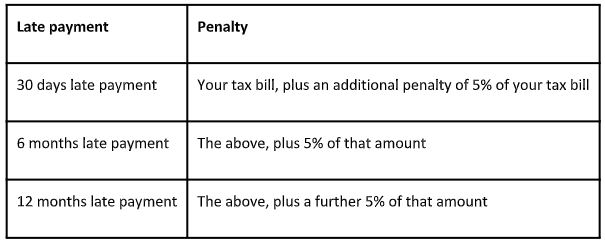

Fines for late payment

HMRC penalizes you for missing the Self-Assessment submission deadline, but apart from that, there are fines for missing the payment deadline as well.

Don’t forget payments on account

Payments on account are intended to spread the cost of Self-Assessment income tax and Class 4 National Insurance contributions. If your tax bill is more than £1,000 for a tax year, you’re required to make a payment on account the following tax year.

It’s basically an advance payment on next year’s bill, working on the assumption that your earnings will be the same as or higher than the previous year.

The rationale behind this is to ensure that the taxpayer doesn’t have to pay one massive bill in January. In practice it means that you will pay 50% of the previous year’s bill as an advance against tax for the following tax year.

The deadline date for your first payment on account is 31st July. Missing the deadline also incurs penalties.

What if I don’t qualify to submit a tax return?

Some people are caught out by thinking that because they don’t fall into the tax paying bracket and are exempt from paying taxes in a particular year, they don’t need to submit. Sadly, this isn’t the case. Unless you tell them otherwise, HMRC expect a Self-Assessment return from anyone who is registered for it.

Is there any way to avoid fines?

HMRC will sometimes waive off penalties if you have a “reasonable excuse” though they’re pretty strict on what might count as a reasonable excuse.

It’s up to their discretion, though a taxpayer may be excused if they’ve been seriously ill, suffered bereavement close to the deadline or the business had some serious IT problems.

One has the right to appeal against a penalty, if you think it was given unfairly, using a SA370 form or the online service.

Talk to one of our team members about our accounting services, including tax returns. Call 020 3026 8614, or schedule an appointment online.

My brother recommended I might like this web site. He was totally right. Karlyn Fredrick Zaid