Covid 19: Furlough Scheme Extended

The Coronavirus Job Retention Scheme has been extended for a month with employees receiving 80% of their current salary for hours not worked and further economic support announced.

Furlough scheme will remain open until December, with employees receiving 80% of their current salary for hours not worked, up to a maximum of £2,500. Under the extended scheme, the cost for employers of retaining workers will be reduced compared to the current scheme, which ends today. This means the extended furlough scheme is more generous for employers than it was in October.

EXTENDED JOB RETENTION SCHEME

-

1) This extended Job Retention Scheme will operate as the previous scheme did, with businesses being paid upfront to cover wages costs. There will be a short period when we need to change the legal terms of the scheme and update the system and businesses will be paid in arrears for that period.

2) The CJRS is being extended until December. The level of the grant will mirror levels available under the CJRS in August, so the government will pay 80% of wages up to a cap of £2,500 and employers will pay employer National Insurance Contributions (NICs) and pension contributions only for the hours the employee does not work.

3) As under the current CJRS, flexible furloughing will be allowed in addition to full-time furloughing.

4) Further details, including how to claim this extended support through an updated claims service, will be provided shortly.

5) The Job Support Scheme will be introduced following the end of the CJRS.

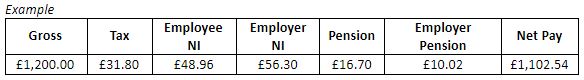

Employee is not working and has been put on Furlough

Normal Gross Pay = £1500

80% Furlough claim = £1500*80% = £1200

Employer Cost (£56.30+£10.02) = £66.32 – Borne by the employer

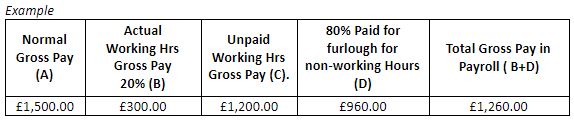

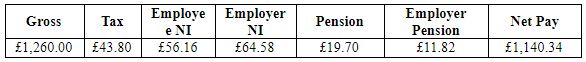

Employee work only 20% hours and for rest has been put on Furlough

Normal Gross Pay = £1500

20% of normal working hours worked by employee £1500 x 20%= £300.00

80% is non-working hours gross pay – £1500 x 80% = £1200.00

80% Government will pay for non-working hours £1200* X 80% = £960.00

Gross Pay in Payroll = Actual working hours pay £300 + Furlough Amount £960.00 = £1,260.00

Employer Cost (£64.58+£11.82) £76.40 – Borne by the employer

ELIGIBILITY

For Employers:

-

1) All employers with a UK bank account and UK PAYE schemes can claim the grant. Neither the employer nor the employee needs to have previously used the CJRS.

2) The government expects that publicly funded organisations will not use the scheme, as has already been the case for CJRS, but partially publicly funded organizations may be eligible where their private revenues have been disrupted. All other eligibility requirements apply to these employers.

For Employees:

-

1) To be eligible to be claimed for under this extension, employees must be on an employer’s PAYE payroll by 23:59 30th October 2020. This means a Real Time Information (RTI) submission notifying payment for that employee to HMRC must have been made on or before 30th October 2020.

2) Employees can be on any type of contract. Employers will be able to agree any working arrangements with employees.

3) Employers can claim the grant for the hours their employees are not working, calculated by reference to their usual hours worked in a claim period. Such calculations will broadly follow the same methodology as currently under the CJRS.

4) When claiming the CJRS grant for furloughed hours, employers will need to report and claim for a minimum period of 7 consecutive calendar days.

5) Employers will need to report hours worked and the usual hours an employee would be expected to work in a claim period.

6) For worked hours, employees will be paid by their employer subject to their employment contract and employers will be responsible for paying the tax and NICs due on those amounts.

What support is being provided and the associated employer costs:

-

1) For hours not worked by the employee, the government will pay 80% of wages up to a cap of £2,500. The grant must be paid to the employee in full.

2) Employers will pay employer NICs and pension contributions, and should continue to pay the employee for hours worked in the normal way.

3) As with the current CJRS, employers are still able to choose to top up employee wages above the scheme grant at their own expense if they wish.

JOB RETENTION SCHEME: POSTPONED

The Job Support Scheme, which was scheduled to come in on Sunday 1st November, has been postponed until the furlough scheme ends.

Employers small or large, charitable or non-profit are eligible for the extended Job Retention Scheme, which will continue for a further month.

Businesses will have flexibility to bring furloughed employees back to work on a part time basis or furlough them full-time, and will only be asked to cover National Insurance and employer pension contributions which, for the average claim, accounts for just 5% of total employment costs.

I was looking for this certain info for a very long time. Thank you and best of luck. Silva Donal Sandi

I think you have remarked some very interesting points , appreciate it for the post. Kiele Marcel Minnnie