Stamp Duty Land Tax (SDLT) is payable where property is acquired in England and Northern Ireland. Land and Building Transaction Tax (LBTT) is payable in Scotland and Land Transaction Tax (LTT) is payable in Wales,

SDLT is payable where the chargeable consideration exceeds the relevant threshold at the rates applicable to each slice of the consideration. A supplement of 3% applies to second and subsequent residential properties where the consideration is more than £40,000. The supplement does not apply where the main residence is exchanged.

Temporary increase in residential threshold

The SDLT residential threshold was temporarily increased to £500,000 from 8 July 2020 to 31 March 2021. The thresholds applying for LBTT and LTT were also increased for a temporary period, but these are not considered here.

Property investors and those buying second homes also benefitted from the increase as the 3% supplement is applied to the rates, as reduced.

Extension

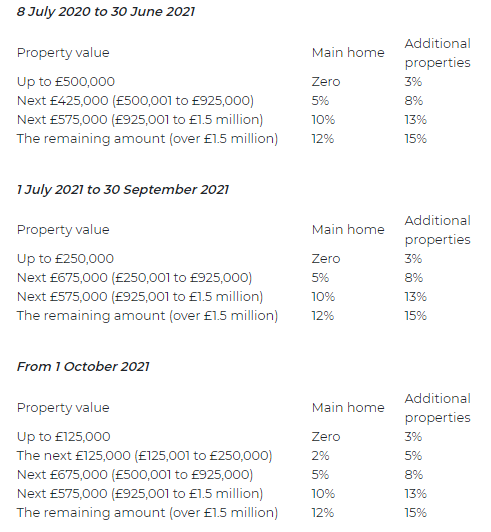

The residential threshold will remain at £500,000 beyond 31 March 2021 and will stay at this level until 30 June 2021. From 1 July 2021 until 30 September 2021 it will reduce to £250,000 returning to its normal level of £125,000 from 1 October 2021.

The first time buyer threshold will return to £300,000 for properties up to £500,000 from 1 July 2021.

Rates

The rates of SDLT depending on the completion date are shown below.

Window of opportunity

The extension to the period for which the £500,000 threshold is in place provides an opportunity for investors to save money if they can complete by 30 June 2021. If this is not possible, there are still savings on offer where completion takes place by 30 September 2021.

For more information, Book a Free Consultation!