A good way to invest money can be done by buying a property in order to rent it out to tenants. However, no investment is ever completely safe.

That said, buy-to-lets aren’t as straightforward as investing your money in something and simply hope for your investment to grow. Landlords have legal obligations that they must mandatorily comply with, such as ensuring the property is safe for their tenants in addition to the varied taxes that go hand in hand as a result of ownership.

What tax do I need to pay on my buy-to let?

Buy-to-let landlords may need to pay tax:

• when they purchase the property

• on the profits they make from renting it out

• when they sell the property

Paying tax when you buy a property to rent it out

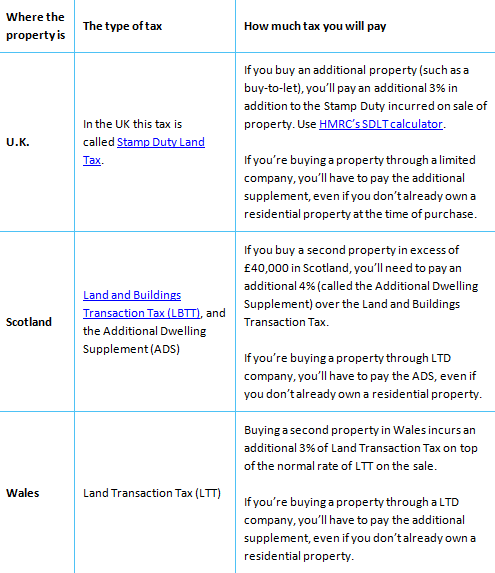

Buying residential property in the UK might incur some tax on the purchase price of the property. For buy-to-lets and additional properties, there could be an additional charge to pay.

The type and rate of tax depends on where the property is located.

Paying tax on the profit earned from renting out

Along with paying tax when you buy the property, you might also have to pay income tax if you earn a profit from renting it out.

The way that you pay other types of tax on the profit that you make depends on how you own the property.

If you own the property personally

Landlords who own their buy-to-let personally have a property allowance. This means that the first £1,000 of income you earn from the property in a tax year is tax free. Then:

• If renting out the property makes you an income of between £1,000 and £2,500 a year, you should contact HMRC to discuss what you need to do.

• You’ll need to submit a Self-Assessment tax return if renting out the property brings you an income of £2,500 to £9,999 after allowable expenses, or £10,000 or more before allowable expenses.

If you would like more information about how we can support your start-up business, you can talk to one of the team. Call 020 3026 8614, or email us on info@cloudtaxltd.com