For tax purposes, furnished holiday lettings are something of a special case and benefit from a number of advantages not available to standard residential lets. One of these advantages is in relation to the treatment of interest and finance costs. Residential landlord – Restriction of relief Residential landlords can now…

Continue ReadingTag: uk property tax

Stamp duty land tax refunds

The additional stamp duty land tax (SDLT) rate of 3% is payable by purchasers of residential properties costing £40,000 or more and if all of the following conditions apply: 1) it will not be the only residential property worth £40,000 or more owned (or part owned) by the purchaser anywhere…

Continue ReadingHow to Calculate Capital gain on the sale of an investment property

If you sell a property that has not been your main residence throughout the period that you have owned it, you may need to pay capital gains tax if a gain arises on the disposal of the property. This may be the case if you have an investment property, such…

Continue ReadingGifting property to the children

No one likes the idea of the taxman taking a chunk of their estate when they die, particularly if it will be necessary to sell a much-loved property to pay the inheritance (IHT) bill. The introduction of the residence nil rate band (RNRB -set at £175,000) means that a couple…

Continue ReadingObtain relief for pre-letting expenses

When starting a new property rental period there will usually be a preparatory phase during which expenses will be incurred. To what extent is relief available for expenses incurred before the property is let? Start of the property rental business A property rental business usually starts when the letting first…

Continue ReadingFurnished holiday lettings

Furnished holiday lettings offer a number of tax advantages over longer lets. One of the key benefits is the availability of capital gains tax reliefs available to traders, including rollover relief and business asset disposal relief. Business asset rollover relief Business asset rollover relief is a significant benefit of having…

Continue ReadingRelief for Interest Costs – Unincorporated business Vs Limited company

Most landlords will need some sort of finance in order to invest in property to let out. However, while tax relief for mortgage and finance costs are available regardless of whether the property business is operated as an unincorporated property business or whether it is run through a limited company,…

Continue ReadingTax allowances frozen until April 2026

The financial impact of the Covid-19 pandemic is unprecedented and borrowing levels in 2020/21 of 16.9% of GDP represent the highest level of peacetime borrowing. To meet some of this cost, the Chancellor, Rishi Sunak, announced in the 2021 Budget that various thresholds and allowances would remain at their 2021/22…

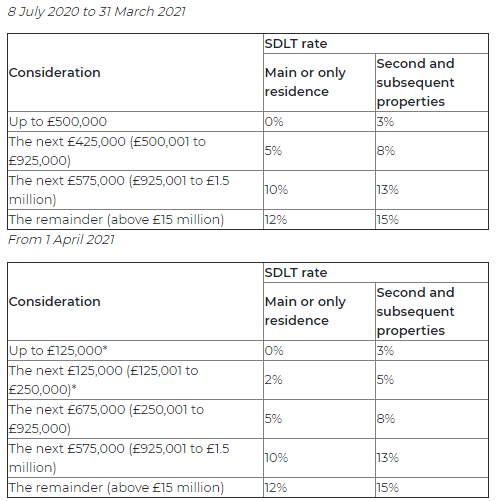

Continue ReadingDeadline to benefit from increased SDLT threshold approaching

In July last year, the Government announced a temporary increase in the residential stamp duty land tax (SDLT) threshold to £500,000. The higher threshold applies where completion takes place between 8 July 2020 and 31 March 2021. From 1 April 2021, the threshold will revert to £125,000, with a higher…

Continue ReadingUnused Residential finance cost

Since 2017/18, the amount of income tax relief that landlords with residential properties have been able to claim on residential property finance costs (e.g. mortgage interest) has gradually been restricted such that for the year 2020/21 the restriction is now given as a tax reducer at the basic rate of…

Continue Reading