Financial years and corporation tax rates Corporation tax (CT) rates are set for “financial years”. A financial year (FY) runs from 1 April to 31 March and is identified by the calendar year in which it commences for example FY 2022 is the year from 1 April 2022 to 31…

Continue ReadingTag: tax return

Making use of a spouse’s allowable losses

Spouses and civil partners benefit from special rules for capital gains tax purposes which allow them to transfer assets between them at a value that gives rise to neither a gain nor a loss. The transferee spouse/civil partner effectively takes on the transferor’s base cost. This can be very useful…

Continue ReadingClaim expenses for additional costs of working from home

As the 2020/21 tax year draws to a close, many employees will have spent much if not all of the last year working from home. While the tax system enables employers to pay employees a tax-free allowance of £6 per week (£26 per month) to cover the additional household costs…

Continue ReadingCan you claim the Employment Allowance for 2021/22?

The Employment Allowance is a National Insurance allowance that enables eligible employers to reduce their employers’ (secondary) Class 1 National Insurance bill by up to £4,000. However, not all employers can benefit – there are some important exclusions. Eligible employers To qualify for the Employment Allowance, the employer’s Class 1…

Continue ReadingTax allowances frozen until April 2026

The financial impact of the Covid-19 pandemic is unprecedented and borrowing levels in 2020/21 of 16.9% of GDP represent the highest level of peacetime borrowing. To meet some of this cost, the Chancellor, Rishi Sunak, announced in the 2021 Budget that various thresholds and allowances would remain at their 2021/22…

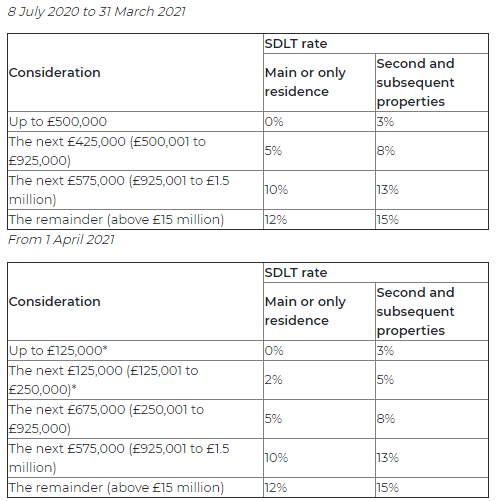

Continue ReadingDeadline to benefit from increased SDLT threshold approaching

In July last year, the Government announced a temporary increase in the residential stamp duty land tax (SDLT) threshold to £500,000. The higher threshold applies where completion takes place between 8 July 2020 and 31 March 2021. From 1 April 2021, the threshold will revert to £125,000, with a higher…

Continue ReadingAre you Trading?

Lockdown restrictions have forced many businesses to close temporarily. Selling goods or clothes on sites such as eBay and Depop offers the opportunity to raise some much-needed cash in these difficult times. But what are the associated tax implications and do you need to tell HMRC about it? Badges of…

Continue ReadingSelf employment & the £2,000 Dividend Allowance

All taxpayers, regardless of the rate at which they pay tax, are entitled to a tax-free allowance for dividends. For 2020/21 this is set at £2,000, so if you’re thinking of branching out to be self-employed or have made the switch last year, this is what you need to consider.…

Continue ReadingTime to pay your Payment on Account

As part of the Chancellor’s Coronavirus support package taxpayers were permitted to defer payment of the July 2020 income tax Payment on Account instalment until 31 January 2021. However, three lockdowns later and HMRC have become increasingly aware that a large number of taxpayers are still needing to delay not…

Continue ReadingWhat happens if my Self-assessment is late?

The deadline for submitting your Self-Assessment online, and paying any tax you owe, is midnight on the 31st January. If you prefer to submit a paper based return, the submission deadline is 31st October. But what happens if you are late in submitting your tax return? Unfortunately you’ll face an…

Continue Reading