To encourage companies to invest, enhanced capital allowances are available for expenditure incurred within a limited two-year window. As an alternative to the annual investment allowance (AIA), companies will be able to benefit from either a super-deduction or a new first-year allowance, depending on whether the expenditure is on assets…

Continue ReadingTag: tax planning

Tax allowances frozen until April 2026

The financial impact of the Covid-19 pandemic is unprecedented and borrowing levels in 2020/21 of 16.9% of GDP represent the highest level of peacetime borrowing. To meet some of this cost, the Chancellor, Rishi Sunak, announced in the 2021 Budget that various thresholds and allowances would remain at their 2021/22…

Continue ReadingTake advantage of the enhanced carry back of losses

Many businesses have suffered losses as a result of the Covid-19 pandemic, and where a business has made a loss, various options are available to obtain relief for that loss. The challenge is to make the best use of the loss. To help loss-making businesses, legislation is to be introduced…

Continue ReadingNew VAT Reverse Charge For Construction Sector

Domestic reverse charge VAT legislation is about to change the way CIS registered construction businesses handle and pay VAT. From 1 March 2021, many contractors in the construction industry will stop paying VAT to their subcontractors. Instead, the contractor will pay the VAT directly to HM Revenue & Customs. This…

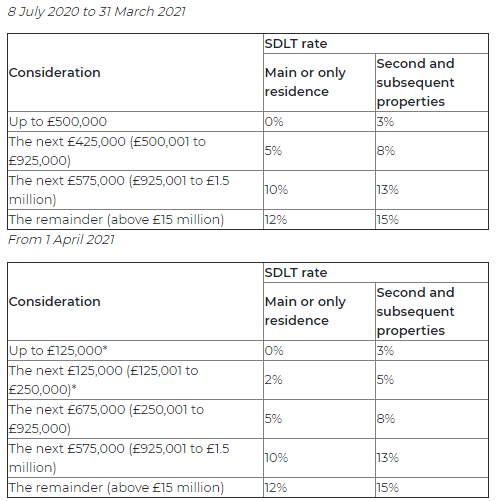

Continue ReadingDeadline to benefit from increased SDLT threshold approaching

In July last year, the Government announced a temporary increase in the residential stamp duty land tax (SDLT) threshold to £500,000. The higher threshold applies where completion takes place between 8 July 2020 and 31 March 2021. From 1 April 2021, the threshold will revert to £125,000, with a higher…

Continue ReadingDividends : Legal Vs Illegal

Changed business conditions in light of the Coronavirus pandemic have caused many companies to review their dividend policies not least because the company’s financial position may have deteriorated significantly from that shown in its last annual accounts. The Companies Act 2006 requires that a dividend be paid only if there…

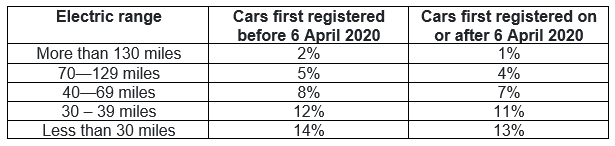

Continue ReadingElectric Cars – April 2021

For 2020/21, it was possible to enjoy an electric company car as a tax-free benefit. While this will no longer be the case for 2021/22, electric and low emission cars remain a tax-efficient benefit. How are electric cars taxed? Under the company car tax rules, a taxable benefit arises in…

Continue ReadingSelf employment & the £2,000 Dividend Allowance

All taxpayers, regardless of the rate at which they pay tax, are entitled to a tax-free allowance for dividends. For 2020/21 this is set at £2,000, so if you’re thinking of branching out to be self-employed or have made the switch last year, this is what you need to consider.…

Continue ReadingUnused Residential finance cost

Since 2017/18, the amount of income tax relief that landlords with residential properties have been able to claim on residential property finance costs (e.g. mortgage interest) has gradually been restricted such that for the year 2020/21 the restriction is now given as a tax reducer at the basic rate of…

Continue ReadingAdvantages of using a property LLP

A limited liability partnership (LLP) can be used for a property business and offers some advantages over unincorporated businesses and limited liability companies. A property LLP is something of a halfway house, providing the comfort of limited liability with the flexibility as to how profits are shared. The use of…

Continue Reading