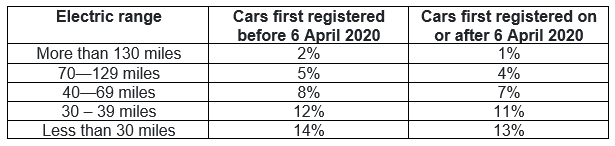

For 2020/21, it was possible to enjoy an electric company car as a tax-free benefit. While this will no longer be the case for 2021/22, electric and low emission cars remain a tax-efficient benefit. How are electric cars taxed? Under the company car tax rules, a taxable benefit arises in…

Continue ReadingTag: mileage allowance uk

Using your own car in your property business

A landlord running an incorporated business is likely to need to use their own car for the purposes of the business. Where this is the case, what can they claim by way of expenses? Two options Costs incurred wholly and exclusively for business purposes can be deducted when working out…

Continue Reading