Changed business conditions in light of the Coronavirus pandemic have caused many companies to review their dividend policies not least because the company’s financial position may have deteriorated significantly from that shown in its last annual accounts. The Companies Act 2006 requires that a dividend be paid only if there…

Continue ReadingTag: cloud tax ltd

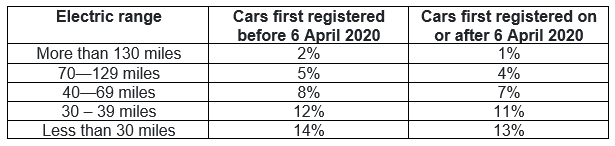

Electric Cars – April 2021

For 2020/21, it was possible to enjoy an electric company car as a tax-free benefit. While this will no longer be the case for 2021/22, electric and low emission cars remain a tax-efficient benefit. How are electric cars taxed? Under the company car tax rules, a taxable benefit arises in…

Continue ReadingAre you Trading?

Lockdown restrictions have forced many businesses to close temporarily. Selling goods or clothes on sites such as eBay and Depop offers the opportunity to raise some much-needed cash in these difficult times. But what are the associated tax implications and do you need to tell HMRC about it? Badges of…

Continue ReadingSelf employment & the £2,000 Dividend Allowance

All taxpayers, regardless of the rate at which they pay tax, are entitled to a tax-free allowance for dividends. For 2020/21 this is set at £2,000, so if you’re thinking of branching out to be self-employed or have made the switch last year, this is what you need to consider.…

Continue ReadingUnused Residential finance cost

Since 2017/18, the amount of income tax relief that landlords with residential properties have been able to claim on residential property finance costs (e.g. mortgage interest) has gradually been restricted such that for the year 2020/21 the restriction is now given as a tax reducer at the basic rate of…

Continue ReadingNew VAT rules for the construction sector

New VAT rules are due to come into effect this March which will impact on accounting for VAT for transactions in the construction sector. The new rules are called “the domestic reverse charge for supplies of building and construction services”. The new “reverse charge” system of VAT accounting will affect…

Continue ReadingTime to pay your Payment on Account

As part of the Chancellor’s Coronavirus support package taxpayers were permitted to defer payment of the July 2020 income tax Payment on Account instalment until 31 January 2021. However, three lockdowns later and HMRC have become increasingly aware that a large number of taxpayers are still needing to delay not…

Continue ReadingEmployee well being in 2021

The pandemic has encouraged most businesses to focus on the wellbeing of their team. 2020 has been a challenging year for all of us. As most businesses were forced to shift to remote working, the importance of employee wellbeing moved towards the top of the agenda. Firms around the world…

Continue ReadingRecent Issues in EMI schemes

When it was first introduced in 2000, the Enterprise Management Incentive (EMI) scheme had an initial life expectancy of around five years, but arrangements proved to be so popular with employers and employees alike that the scheme is still going strong some twenty years on. In broad terms, the EMI…

Continue ReadingWhat tax do I need to pay by 31 January 2021?

The self-assessment tax return for 2019/20 must be filed by midnight on 31 January 2021. If you miss this deadline, you will automatically receive a late filing penalty of £100, regardless of whether you owe any tax, unless you are able to convince HMRC that you have a reasonable excuse…

Continue Reading