Most landlords will need some sort of finance in order to invest in property to let out. However, while tax relief for mortgage and finance costs are available regardless of whether the property business is operated as an unincorporated property business or whether it is run through a limited company, the mechanism and extent of the relief differ.

Unincorporated property business

The way in which relief is given for interest and finance costs incurred by an unincorporated property business has changed in recent years, moving gradually from a system of relief by deduction to relief as a basic rate tax reduction. The transition is now complete.

The effect of this is that rather than deducting interest and finance costs, such as mortgage interest, when calculating the profits of the property rental business, these costs are ignored initially. Relief is given at a later stage as a reduction when working out the amount of tax that the landlord has to pay. The reduction is equal to 20% of the allowable interest and finance costs or, if lower, the amount that reduces the landlord’s tax bill to nil.

This is illustrated in the following example.

Example 1

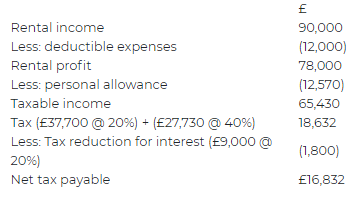

Malcolm is a landlord running an unincorporated property rental business. His rental income for 2021/22 is £90,000. He incurs deductible expenses of £12,000 and mortgage interest of £9,000. He has no other income.

His tax position is as follows:

Although Malcolm pays tax at the higher rate, relief for his interest costs is only available at the basic rate.

Where the tax liability is insufficient for relief to be given for the full amount of the interest, unrelieved interest costs can be carried forward and relieved (as a basic rate tax reduction) in a future year.

Limited company

The rules restricting relief for interest do not apply to limited companies. Instead, interest is deductible in accordance with the loan relationship rule. As a result, interest and finance costs are deducted in full in calculating the taxable rental profits of the company. This means relief is given in full at the prevailing rate of corporation tax. Further, interest costs can be deducted in full, even where this creates a loss.

Example 2

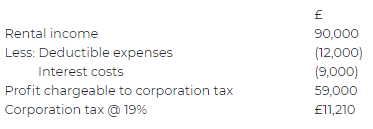

M Ltd, like Malcolm in example 1, has rental profits for the year to 31 March 2022 of £80,000. It too incurs deductible expenses of £12,000 and interest and finance costs of £9,000. The company’s tax liability is calculated as follows:

Not the end of the story

The fact that the interest restriction does not apply to companies, together with a corporation tax rate that is less than the basic rate of income tax, may suggest at first sight that it will always be better to operate as a limited company. However, that is not the end of the story – profits from a company will need to be extracted if the landlord wishes to use them personally, and this may incur additional tax and National Insurance liabilities.

For more information, Book a Free Consultation!