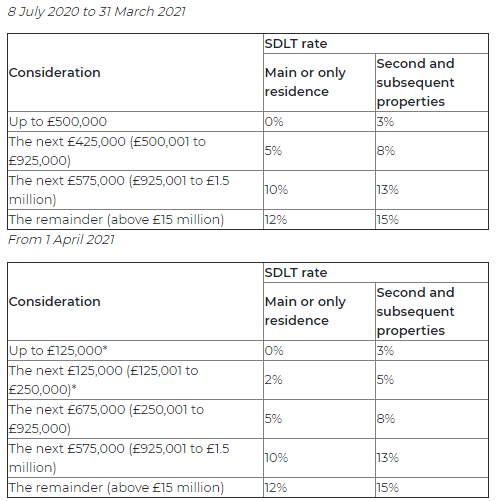

In July last year, the Government announced a temporary increase in the residential stamp duty land tax (SDLT) threshold to £500,000. The higher threshold applies where completion takes place between 8 July 2020 and 31 March 2021. From 1 April 2021, the threshold will revert to £125,000, with a higher…

Continue ReadingBlog

Dividends : Legal Vs Illegal

Changed business conditions in light of the Coronavirus pandemic have caused many companies to review their dividend policies not least because the company’s financial position may have deteriorated significantly from that shown in its last annual accounts. The Companies Act 2006 requires that a dividend be paid only if there…

Continue ReadingHOW TO BUILD YOUR 2021 BUSINESS STRATEGY IN THE FACE OF UNCERTAINTY

We live in uncertain times and planning for the future is challenging. Rather than paying attention to what you can’t do, focus on what you can do. For example, when restaurants couldn’t serve customers indoors, they transitioned to delivery, take-away and outdoor dining. Regardless of the type of business that…

Continue ReadingHoliday entitlement and pay during coronavirus (COVID-19)

If you’ve put employees on furlough during the pandemic, they’ll likely have a large amount of accrued holiday. Sounds great – for them! The problem arises when employees return to work with lots of carried over holiday, looking to take off large periods of time. This can cause huge staffing…

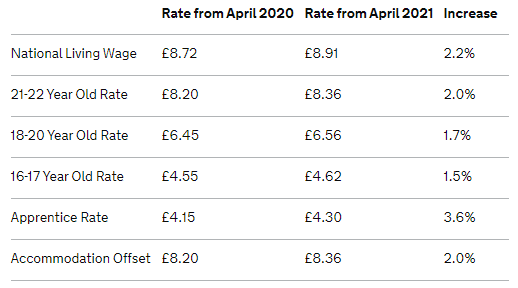

Continue ReadingNational Living Wage and National Minimum Wage changes from April 2021

Under the minimum wage legislation, workers must be paid at least the statutory minimum wage for their age. There are two types of minimum wage – the National Living Wage (NLW) and the National Minimum Wage (NMW). From 1 April 2021, as well as the usual annual increases, the age…

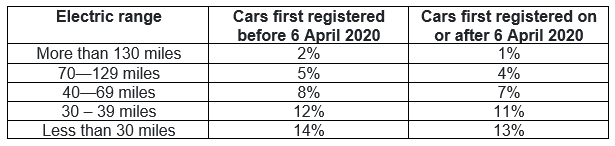

Continue ReadingElectric Cars – April 2021

For 2020/21, it was possible to enjoy an electric company car as a tax-free benefit. While this will no longer be the case for 2021/22, electric and low emission cars remain a tax-efficient benefit. How are electric cars taxed? Under the company car tax rules, a taxable benefit arises in…

Continue ReadingAre you Trading?

Lockdown restrictions have forced many businesses to close temporarily. Selling goods or clothes on sites such as eBay and Depop offers the opportunity to raise some much-needed cash in these difficult times. But what are the associated tax implications and do you need to tell HMRC about it? Badges of…

Continue ReadingSelf employment & the £2,000 Dividend Allowance

All taxpayers, regardless of the rate at which they pay tax, are entitled to a tax-free allowance for dividends. For 2020/21 this is set at £2,000, so if you’re thinking of branching out to be self-employed or have made the switch last year, this is what you need to consider.…

Continue ReadingUnused Residential finance cost

Since 2017/18, the amount of income tax relief that landlords with residential properties have been able to claim on residential property finance costs (e.g. mortgage interest) has gradually been restricted such that for the year 2020/21 the restriction is now given as a tax reducer at the basic rate of…

Continue ReadingNew VAT rules for the construction sector

New VAT rules are due to come into effect this March which will impact on accounting for VAT for transactions in the construction sector. The new rules are called “the domestic reverse charge for supplies of building and construction services”. The new “reverse charge” system of VAT accounting will affect…

Continue Reading