The Recovery Loan Scheme supports access to finance for UK businesses as they grow and recover from the disruption of the COVID-19 pandemic.

Up to £10 million is available per business. The actual amount offered, and the terms, are at the discretion of participating lenders.

The government guarantees 80% of the finance to the lender. As the borrower, you are always 100% liable for the debt.

The scheme is open until 31 December 2021, subject to review.

Loans are available through a network of accredited lenders, listed on the British Business Bank’s website.

Eligibility

You can apply for a loan if your business:

• is trading in the UK

You need to show that your business:

• would be viable were it not for the pandemic

• has been adversely impacted by the pandemic

• is not in collective insolvency proceedings (unless your business is in scope of the Northern Ireland Protocol in which case different eligibility rules may apply)

Businesses that received support under the earlier COVID-19 guaranteed loan schemes are still eligible to access finance under this scheme if they meet all other eligibility criteria.

Who cannot apply

Businesses from any sector can apply, except:

• banks, building societies, insurers and reinsurers (but not insurance brokers)

• public-sector bodies

• state-funded primary and secondary schools

What you can get

• term loans or overdrafts of between £25,001 and £10 million per business

• invoice or asset finance of between £1,000 and £10 million per business

No personal guarantees will be taken on facilities up to £250,000, and a borrower’s principal private residence cannot be taken as security.

How long the loan is for

The maximum length of the facility depends on the type of finance you apply for and will be:

• up to 3 years for overdrafts and invoice finance facilities

• up to 6 years for loans and asset finance facilities

How to apply

Find a lender accredited to offer Recovery Loans from the list on the British Business Bank website: Recovery Loan Scheme: current accredited lenders – British Business Bank (british-business-bank.co.uk)

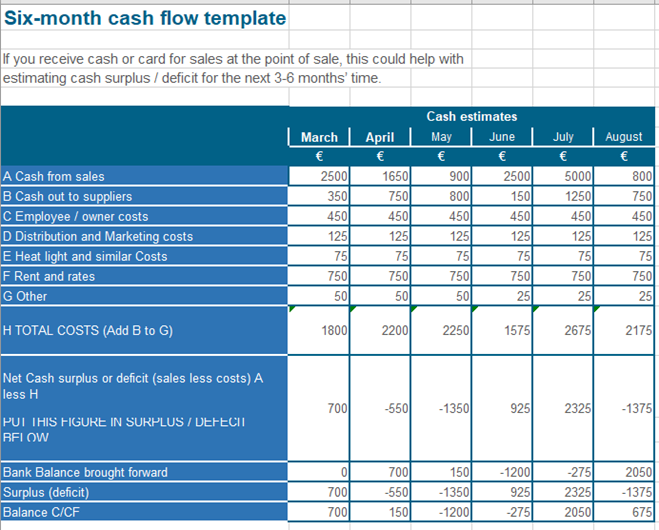

Cash flow planning

Cash flow and business planning in these uncertain times may appear difficult, but there are some practical steps you can take to minimize potential disruption to your business:

• Review your Budgets and set realistic and achievable targets for the remainder of 2021.

• Get your employees involved in a discussion of likely trading conditions and get their input on reducing costs and maintaining revenues.

• Review and flow chart the main processes in your business (e.g. Sales processing, order fulfilment, shipping etc.) and challenge the need for each step.

• Put extra effort into making sure your relationships with your customers are solid.

• Review your list of products and services and eliminate those that are unprofitable or not core products/services.

• Review efficiency of business processes and consider alternatives such as outsourcing certain activities locally or overseas.

• Agree extended payment terms with all suppliers in advance.

• Pull everyone together and explain the business strategy and get their buy-in.